GST Registration in Australia

Understanding GST registration in Australia is an important step for any business. It tells the Australian Taxation Office (ATO) that you need to collect and pay the 10% Goods and Services Tax.

For business owners, registration has real benefits. It enables you to issue accurate tax invoices, claim GST credits on your expenses, and remain compliant by lodging your Business Activity Statements (BAS).

Some businesses already have an ABN but don’t need full registration. This is where GST-only registration comes in. And if you ever need to confirm your status, your GST registration number can be found quickly using the ABN Lookup tool.

Who Needs to Register for GST?

In Australia, most businesses are required to register for the Goods and Services Tax (GST) once their annual turnover exceeds the GST threshold of $75,000. For non-profit organizations, the threshold is higher at $150,000. Turnover refers to your gross business income (excluding GST), not your profit.

Do You Need to Register for GST? Find Out Instantly with Our Free Turnover GST Calculator.

Mandatory Registration for some Industries

Some industries must register for GST regardless of turnover such as:

- Taxi and ride-sourcing drivers (including Uber and similar services).

- Agencies importing goods or services that attract GST.

- Businesses making taxable sales on behalf of others (like commission agents).

For these groups, GST registration is compulsory from the start.

Volunteer GST Registration

You can still choose voluntary registration if your business turnover is under the threshold. Many small businesses do this because it allows them to:

- Claim GST credits on business purchases.

- Issue tax invoices that include GST (helpful when dealing with GST-registered clients).

- Build credibility with larger businesses and government contracts.

Voluntary registration means you’ll also need to lodge regular Business Activity Statements (BAS) and meet the same obligations as businesses over the threshold.

How to Register for GST in Australia?

Getting started with GST registration in Australia is straightforward once you know the options available. Here’s how you can apply:

Applying online via ATO

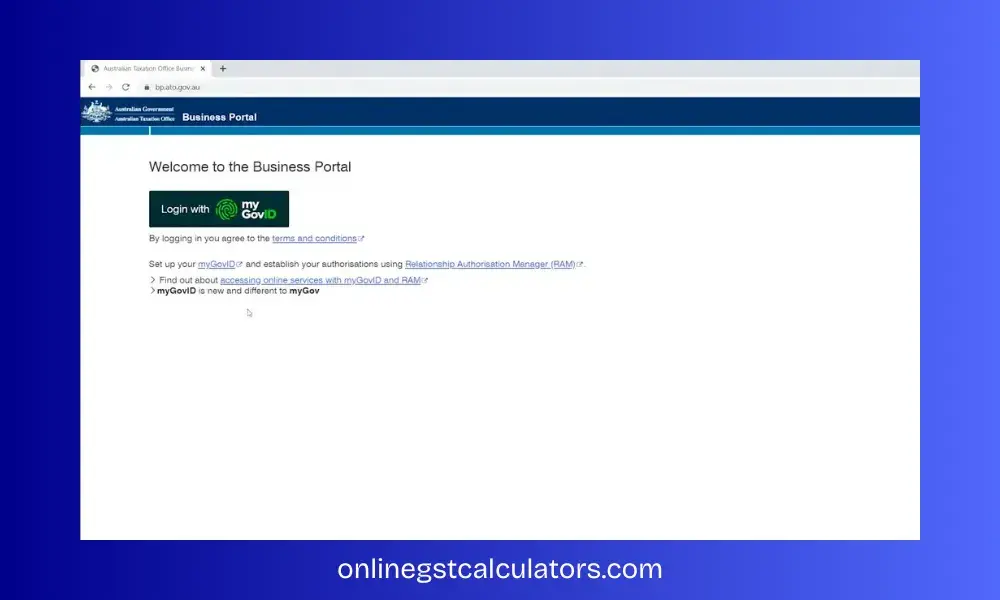

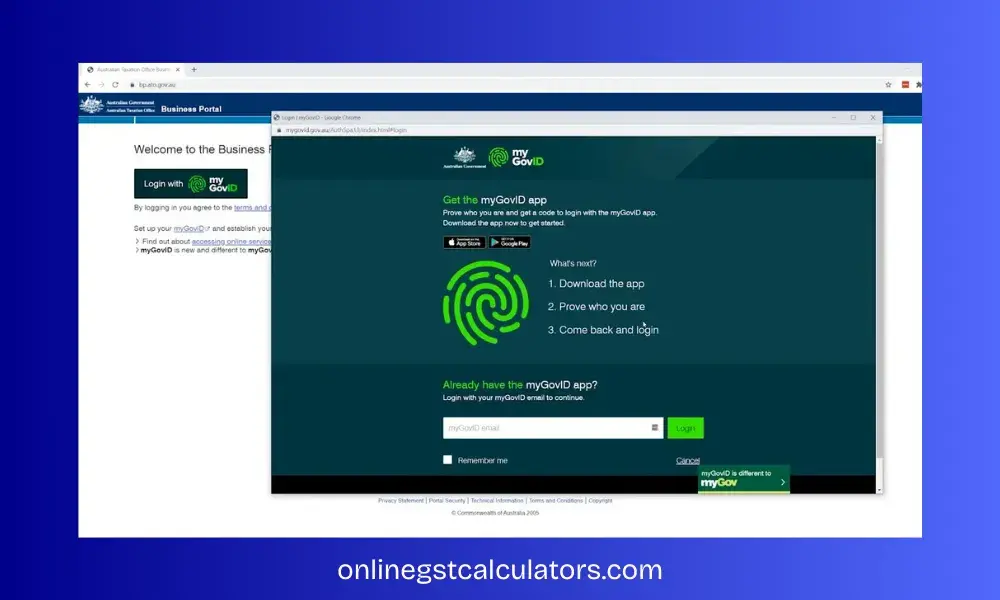

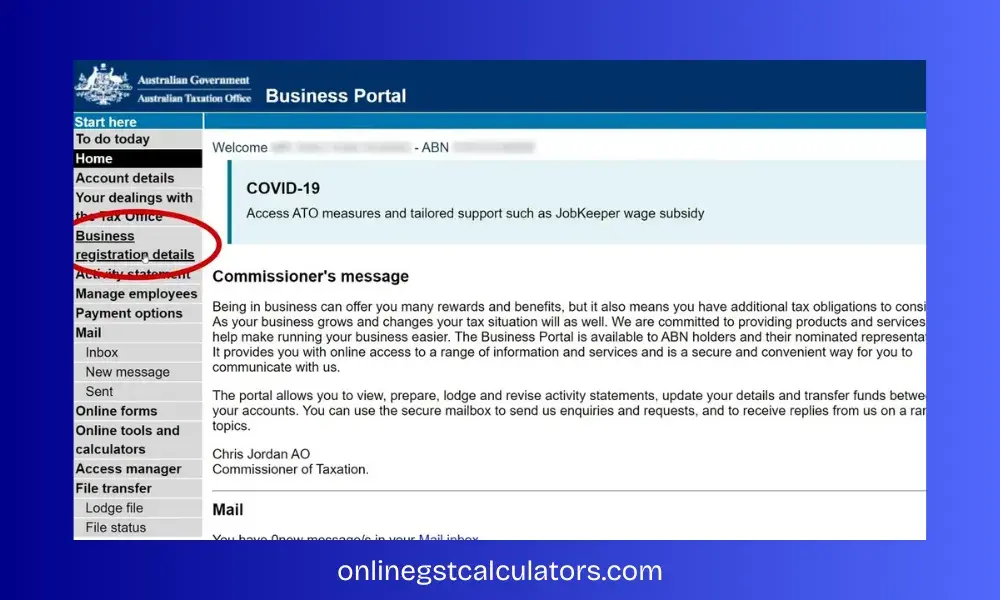

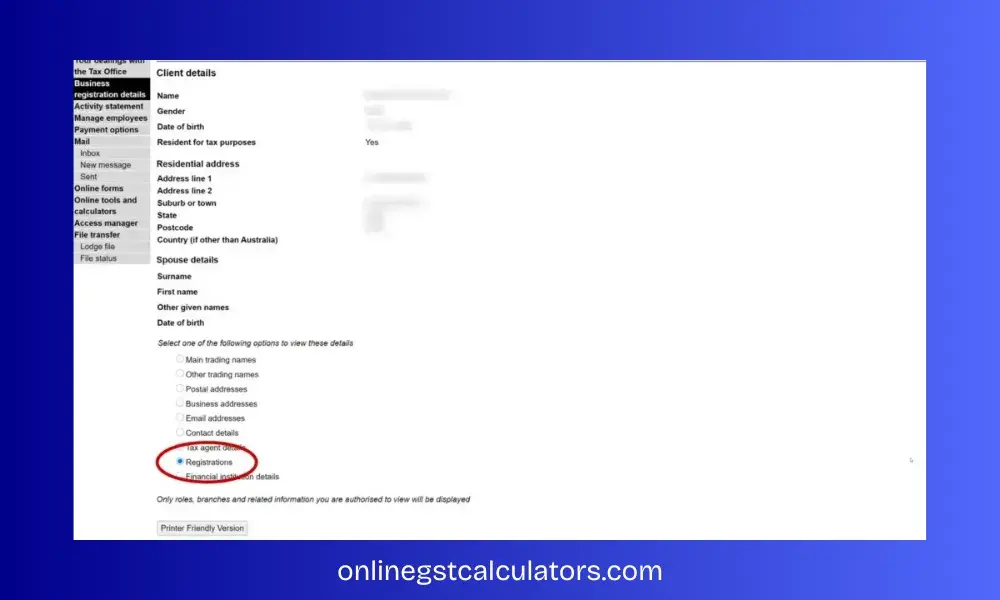

The ATO makes it simple for businesses to register directly online. It is the best and most common way to register is through the Australian Taxation Office (ATO). You’ll need an Australian Business Number (ABN) before you can apply. Registration can be completed via the ATO Business Portal, your myGov account linked to the ATO, or through Online Services for Business. Most applications are processed instantly, and you’ll receive confirmation of your GST registration once approved.

Registering through a tax or BAS Agent

If you’d prefer expert help, you can authorize a registered tax agent or BAS agent to handle the GST registration process. These agents, registered with the Tax Practitioners Board (TPB), can apply for GST on your behalf and provide advice on whether your business meets the GST turnover threshold. This can be especially useful if you’re unsure whether your business has reached the GST turnover threshold or if you want to avoid errors that may lead to ATO penalties.

What details do you need to apply

Before you begin, make sure you have these key details ready.

- Your ABN

- Business and trading names

- Your business structure (sole trader, company, partnership, trust)

- Business activity description (what your business does)

- Contact details (address, phone, email)

- Bank account details (for GST refunds and credits)

- Your estimated annual GST turnover

- The effective start date of your GST registration (you can request a backdate if eligible)

Preparing this information in advance makes the registration process faster and ensures your application is processed without delays.

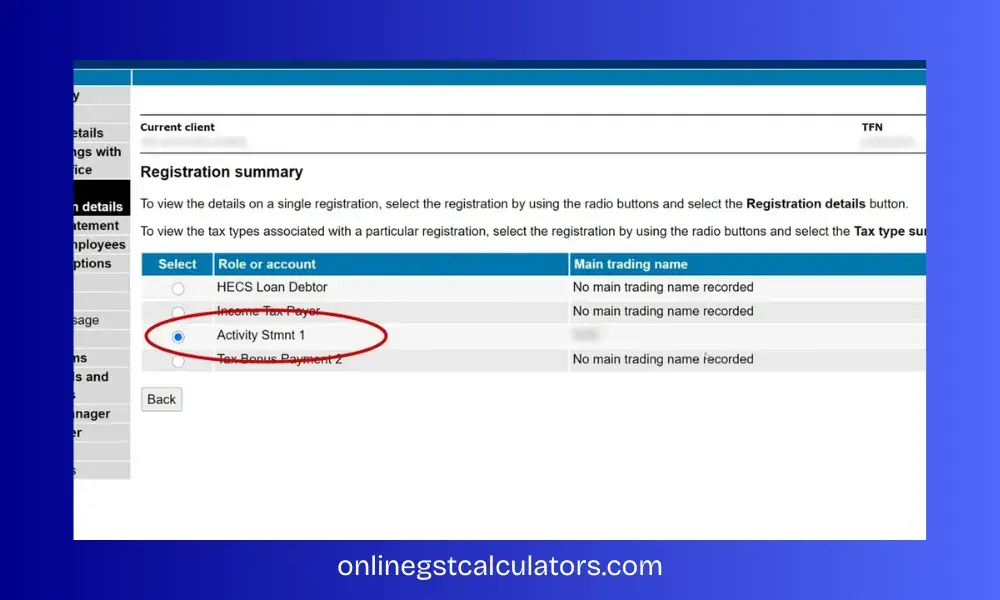

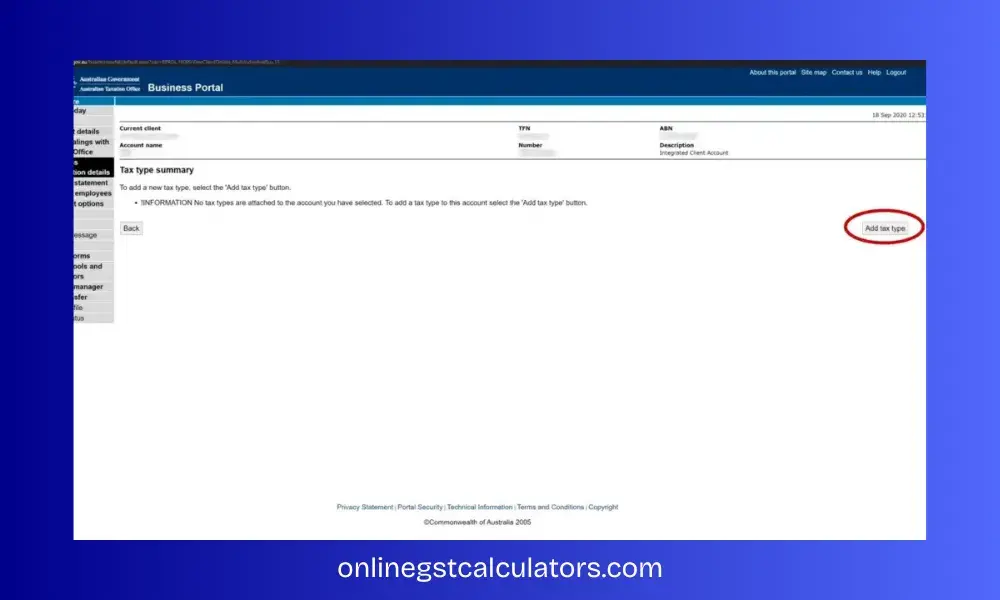

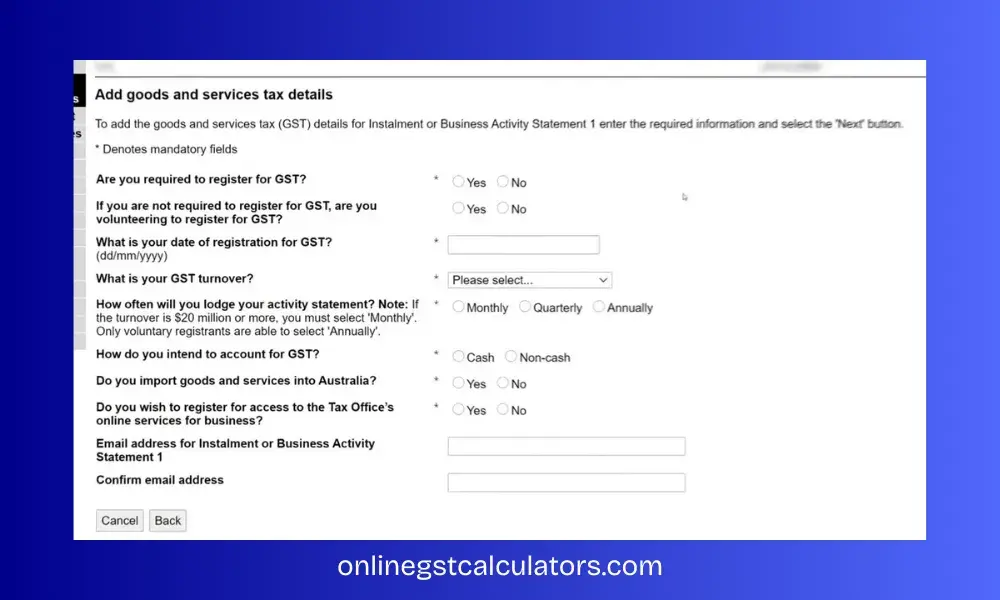

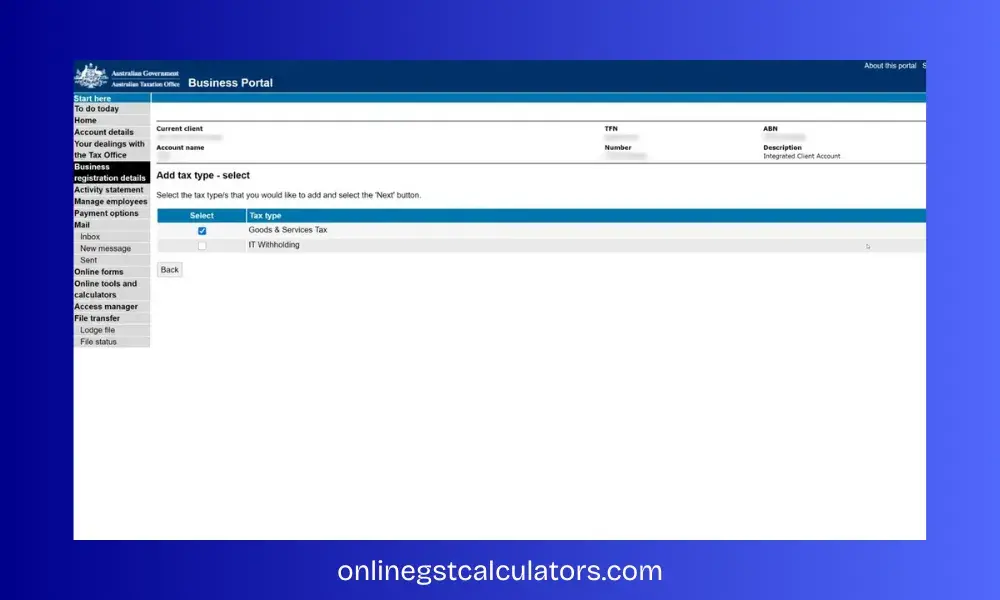

Screenshots for GST Registration

How to UseTurnover GST Calculator

Steps to check GST registration requirement:

- Choose your type: Business/Individual or Not-for-Profit organisation.

- Enter your total turnover for the current financial year (July 1 – June 30).

- Enter your average monthly turnover.

- Click “Check” to see if you must register.

- Use “Clear” to reset.

When to Register for GST

The timing of your GST registration is crucial in Australia. Get it right, and you’ll stay compliant, avoid penalties, and make sure you’re claiming every GST credit you deserve.

How long does GST registration take?

For most businesses, GST registration is easy and fast. If you apply online through the ATO Business Portal or get a tax or BAS agent to do it for you, approval usually comes instantly. Sometimes the ATO might take a few extra days to review your details, but you’ll always get confirmation once it’s done.

Backdating GST registration

Sometimes a business only realises after the fact that its sales have already passed the $75,000 GST turnover threshold. If this happens, the ATO usually allows you to backdate your GST registration for up to 4 years, provided you can show records of when you crossed the limit. This also means you’ll need to catch up on BAS lodgments for those periods and pay any outstanding GST. In some cases, the ATO may also add interest or penalties.

Deadlines and ATO requirements

- The ATO gives you 21 days to register once your business turnover goes over the threshold:

- $75,000 for most businesses

- $150,000 for non-profits

- If you’re driving for Uber, DiDi, or running a taxi service, you must register for GST, no matter how much you earn. Miss the deadline, and the ATO can backdate your registration and bill you for unpaid GST.

Don’t wait until it’s too late. Register as soon as you’re close to the threshold or earlier if you’d rather be safe than sorry.

What Happens After GST Registration

Once you’re registered for GST, a few key obligations and benefits apply:

Charging GST and Issuing Tax Invoices

You’ll need to add 10% GST to most goods and services you sell in Australia. Customers must be given a tax invoice if they request one and the sale is $82.50 or more (including GST).

Reporting Through Business Activity Statements (BAS)

Registered businesses report their GST to the ATO by lodging a Business Activity Statement (BAS), usually monthly, quarterly, or annually, depending on turnover and ATO requirements.

Claiming GST Credits

If you’ve paid GST on business purchases, you can usually claim GST credits to reduce the net amount you owe the ATO. To do this, you must keep valid tax invoices and accurate records.

Our GST Tool & Resources

Use these trusted tools to handle your GST with confidence whether you’re registering, calculating turnover, or checking BAS refund amounts.

ATO GST Registration Portal

This is the official ATO platform for registering your business for GST. Once you’ve set up myGovID and linked your ABN, you can submit your GST application and manage your business tax settings.

Register via ATO Portal

GST Calculator

Easily calculate 10% GST included or excluded from any amount. Perfect for creating tax invoices or determining the correct GST amount to charge on products and services. Calculate GST with our GST Calculator.

GST Turnover Calculator

Estimate your total business turnover over 12 months to see if you’re above the $75,000 GST registration threshold. This helps you decide when registration becomes mandatory. Calculate GST turnover with our GST Turnover Calculator.

BAS Return & Refund Calculator

This tool shows whether you’ll need to pay GST to the ATO or receive a GST refund after lodging your BAS. Enter your sales and purchase GST it provides a clear picture of your refund or return amount, eliminating the need for guesswork. Calculate with our GST BAS return & refund Calculator.

FAQs

Final Words

Registering for GST isn’t just an ATO requirement, it’s the best move to keep your business compliant, future-ready, and risk-proof. Whether you’re a freelancer or a growing company, knowing when and how to register helps you avoid penalties and stay in control of your cash flow. If you’re unsure, use a turnover calculator or get help from a tax agent so you can focus on running your business with confidence.

By staying on top of your GST obligations, you’ll not only meet ATO requirements but also give your business the credibility and structure it needs to thrive in the Australian market.